Choosing where to Retire

The Case for Retiring Overseas: Financial Freedom, Quality and Dignity

Last updated on September 13th, 2025 at 09:36 am

Everyone has the right to retire with dignity and enjoy a fulfilling life, yet achieving this goal is increasingly challenging as the years go by in western countries. Rising living costs and stagnant wages, particularly in the U. S. since the 1970s, necessitate a significant reevaluation of retirement strategies. Many individuals remain unaware that retiring abroad can offer a more advantageous solution. Traditional retirement models that once indicated a “comfortable” retirement are now outdated and primarily benefit a small, affluent segment of the population, leaving the majority at a disadvantage.

RBA aims to share a message of optimism with those who understand the difficulties of planning a conventional retirement in Western countries and are in search of more effective alternatives. There are indeed superior options available, and everyone should have the opportunity to enjoy a rewarding retirement.

Explore over 200 articles on this website dedicated to retiring better abroad, where you will find practical and constructive insights. We encourage you to reach out with any inquiries you may have. Our goal is to address common concerns about living overseas, including safety, healthcare, affordability, and overall quality of life. There are compelling reasons to consider alternatives to remaining in Western nations, and we are here to help you navigate these choices and follow through in confidence in your actions to make the move.

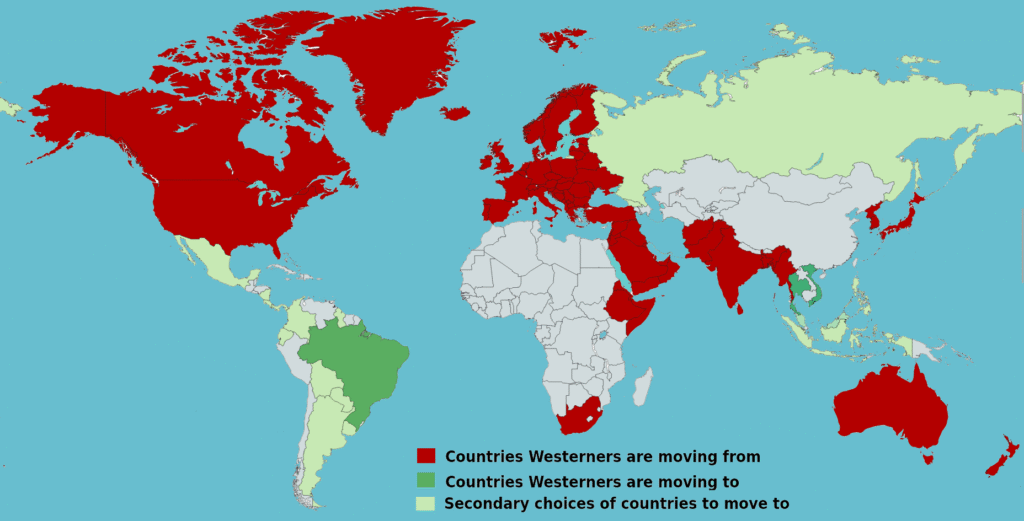

In recent years, an increasing number of citizens from Western countries, often referred to as expats, have begun to seek opportunities for living abroad in pursuit of a better quality of life and to mitigate the rising costs associated with living in their home countries. Many individuals nearing retirement are finding that their long-established financial plans, created over two decades ago, no longer align with the current cost of living. The encouraging news is that relocating outside of Western nations can enable earlier retirement, extend the longevity of savings, and provide a more fulfilling and healthier lifestyle than what is typically available in Western settings. For those residing in Western countries, now is an opportune moment to enhance your quality of life by considering international living options. This website offers valuable insights into more than hundreds of topics related to living abroad.

Let us assist you in discovering your perfect retirement destination!

Rethinking your retirement plan to survive past 2032

Focus on these Key Factors when revising your Financial plans

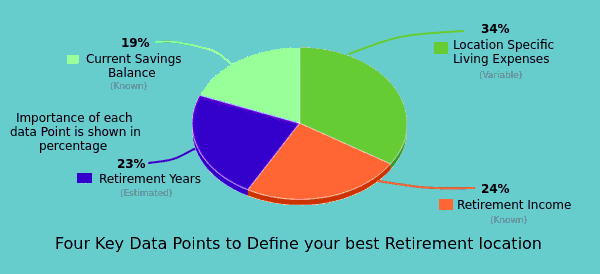

In order to give yourself the best life in retirement, it is crucial to evaluate several key factors that will influence your quality of life in your future years. For many, This is the first time in your life you have no limits on where you live. Here are four essential values to consider:

Total Asset Value: Begin by assessing your total asset value, which can range from $100,000 to $500,000 or more. This figure will serve as the foundation for your retirement planning, determining how much you can afford to spend annually and where you can comfortably live.

Retirement Location: The choice of retirement location can significantly impact your cost of living and overall lifestyle. Consider various locations both domestically and internationally. For instance, while cities like San Francisco or New York may offer vibrant cultures, they also come with high living costs. Alternatively, places like Portugal, Mexico, or even certain areas in the Midwest may provide a lower cost of living, beautiful scenery, and a welcoming community. Researching these options can reveal surprising opportunities that align with your financial situation and lifestyle preferences.

Retirement Income: Your annual retirement income, which may range from $15,000 to $50,000 USD for most, will dictate your spending power. This income can come from various sources, including pensions, Social Security, investments, or savings. Understanding your income will help you determine which locations are feasible based on their cost of living and your desired lifestyle.

Retirement Duration and Start Date: Finally, consider how many years you plan to be retired and when you wish to start this new chapter. If you plan to retire at 65 and expect to live until 85, you will need to budget for 20 years of retirement. This long-term perspective is essential for ensuring that your assets and income can sustain you throughout your retirement years.

By carefully evaluating these four values, you can make informed decisions about your retirement location and lifestyle.

For objective comparisons and deeper insights, it may be beneficial to explore resources such as Expats Living Better, which offers essential information regarding living conditions, expenses, and personal experiences across different locations.

A step-by-step process to define your Paradise

How to Select Your Ideal Retirement Location

Picking where you will live is one of the most important decisions you will ever make. It should be done with careful consideration, research and patience. No one else can know the best place for you to live, only you know what values are most important to your Quality of Life, which allows you to define your best location. We can walk you through how to choose your location, you will make the choice by comparing location specific information to your values.

The Strategy….

- Define a list of your top 20 values, priorities and needs for a living environment. Let’s call it your “Quality of Life” List

- Compare different location’s living environments to select those locations that best meet your criteria.

- Research in more detail the top 3 locations in this list in more detail. I recommend reaching out to those which life in the areas to get first-hand info information you can. Then consider a trip to see for yourself if it’s your paradise.

1. Defining your Quality of Life values

One tip is to start by jotting down a list of what matters most to you, from safety and low cost of living to friendly people and enjoyable lifestyle options. On the flip side, note down what frustrates you, such as high taxes or noisy environments. Using these lists to evaluate potential retirement spots can help you find the best fit. Consider listing at least 30 items for each category, and then selecting the top 20 from each list for easy comparison.

Once you have these lists, guess what? You have already selected your best location! Now just it’s time to recognize it by putting the numbers together by researching which location meets your selection.

2. Comparing different locations’ Quality of Life, listing the Pros and Cons of each.

Use our Retirement Assistant Tool to simply your financial calculations- click here

3. Identified a top 3 locations that best fit your values, do more in-depth research on the top potential retirement locations, until one stands out as the best, then go and visit the location for a few weeks and see if it is a place you can be content.

If Thailand or other countries in South East Asia is a consideration, we can help. See our service page

The Importance of Tailoring Your Retirement Choice to Your Needs

Retirement is one of those rare times in life you have no obligations to pursue a predetermined path. For most of us, it comes as a major change in life that we are unprepared for. It’s natural to look to others for what path is best. But let’s be clear, this is likely the last major choice you will make in this world, so make it be your choice.

When asking for help, keep this in mind, you should be gathering information about your location specific questions, but not advise where to life. Here is why you shouldn’t ask where is a good place to retire.

In the example provided, two individuals express their fondness for visiting Mexico, prompting a third friend to assert that Rocky Point, Mexico is the best destination without understanding the specific reasons behind their preferences. This illustrates a biased viewpoint, as the two friends likely have different interpretations of what they enjoy about Mexico. The crux of the matter is that details are crucial. When considering retirement locations, it is essential to thoroughly investigate various options to find what truly resonates with you. Once you identify a place that feels right, take the time to thoroughly research the location and consider visiting it and ensure it aligns with your vision of happiness, as only you can determine what that entails.

Picking your ideal Location

Picking the right Retirement location to meet your dreams is your key to Success!

Learn more below…

Define your lifestyle priorities to find your best retirement location !

Everyone’s life desires are unique ! Only you can define them to identify your best location.

Compare Retirement Locations costs

Imagine you had a list of financial needs for each location…. We can show you how!

How to plan your financial future in 2025

Here is a secret few people consider, Where you retire is single the most important choice you will make about your retirement plans. This is more critical than your financial status, even your future health and happiness is heavily influenced by where you retire. So why is this not the key priority when “experts” talk about retirement plans?

Your traditional Western Advisors insist you focus on getting in good financial shape (2 million+ USD in Assets is a common number I hear). Then they also recommend having good retirement benefits lined up, including healthcare, life insurance, a good investment portfolio to get you some interest and dividends during retirement. While this would be “ideal” Today, most people find these goals out of reach and out of touch with reality.

The first question you should ask yourself when talking about Retirement is…

“Where can I afford to live a high quality life in retirement for as long as possible and as soon as possible?”

Once you answer this question, you will see all your other retirement plans will work much better, with huge benefits from doing so.

Imagine waking up every morning in a place where your dollar stretches further than you ever thought possible. A warm cup of coffee on the balcony with a view that could only be found in a magazine. This isn’t just a dream; it’s a reality for many who have chosen to retire abroad.

Additional External links to places to Retire